The benefits of maintaining a long-term perspective.

History is unique, but not different. Although, it can be difficult to watch your portfolio dip with the market, it is important to keep in mind that downturns can be painful but have always been a temporary part of the process.

In the last forty years, we have seen thirteen corrections and eight bear markets in global equities. That is about one every other year. Over the last forty years, global equities have increased by a magnitude of seventeen times. Behavioral finance can be quite comical in the sense that people want more of something when the price increases and less of it when the price declines. We think it should be the exact opposite. Legendary investor Warren Buffett says, "he likes his stocks the way he likes his socks... on sale."

During periods of market volatility, it is important that you do not overreact and sell your investments at the bottom, which is guaranteed to derail your path toward achieving your goals.

The chart below shows how a hypothetical $100,000 investment in stocks would have been affected by missing the market's top-performing days over the 20-year period from January 1, 2000 to December 31, 2019. An individual who remained invested for the entire period would have accumulated $324,019, while an investor who missed ten of the top-performing days during that period would have accumulated $161,706.

This is the time to stay diversified and have a long-term perspective!

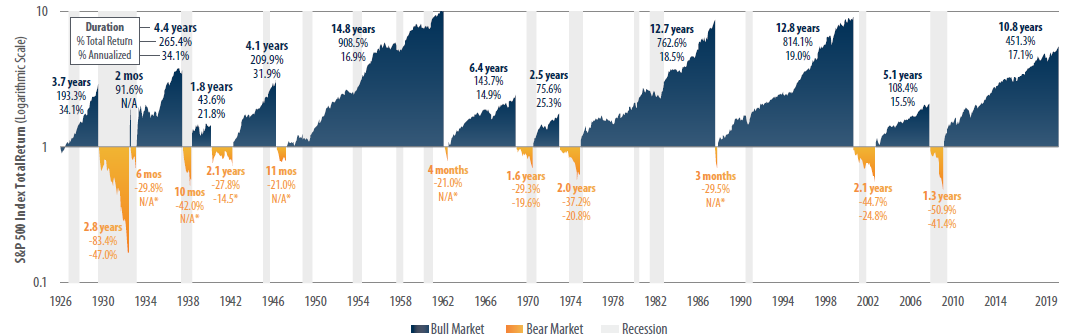

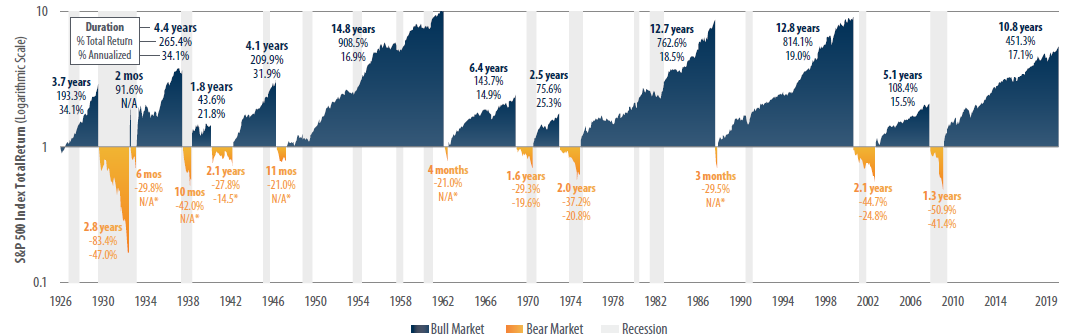

The chart below shows the historical performance of the S&P 500 Index throughout the U.S. Bull and Bear Markets from 1926 through 20The average bull market period has lasted 6.6 years with an average cumulative total return of 339%. The average bear market period lasted 1.3 years with an average cumulative loss of -38%.

It is important to note that a recession did not follow the crash of 1987, which declined roughly 30% from peak to trough and was back to the pre-crash high within two years. Optimistically, one can infer that the Black Monday crash on October 19th, 1987 is similar to this current crash. This can be supported by the fact that this crash happened very quickly and has only wiped out gains in the S&P 500 since the late 2018 lows.

Given the cornucopia of global monetary and fiscal stimulus measures to protect the economy from a potential COVID-19 induced recession, we are likely to repeat a smooth recovery. Although past performance is not a guarantee of future results, we believe that reviewing past expansions and recessions gives us a revitalized perspective on the benefits of investing for the long-term.

Generally, people tend to take one of two strategies during times of uncertainty, either they decide on what should be done or take no action at all. We believe this is the perfect time to review your financial goals and objectives to make sure they are in line with your plan. This includes revisiting what you are trying to achieve, the time horizon of when you would like to achieve these goals, assessing your capacity for risk and reviewing your cash flow needs.

A financial plan helps you see the big picture and set long and short-term life goals, it allows us to take the emotion out of the picture since we know exactly what needs to be done and the appropriate time frame to realize these goals. When you have a financial plan, it is easier to make financial decisions that will keep you on track to meeting your goals. Guidance from a team of seasoned professional will allow you to swiftly adapt to changes in your financial situation and make sure the appropriate strategies and vehicles are optimized.

If you would like to learn more about this topic or are interested in speaking with someone at Coral Gables Trust Company, please contact: John Harris at (305) 443-2544 or This email address is being protected from spambots. You need JavaScript enabled to view it. or Michael Unger at (786) 292.0310 or This email address is being protected from spambots. You need JavaScript enabled to view it.