Coronavirus Induced Market Sell-Off

The world has changed in rapid fashion from canceling worldwide sporting events to limiting our travel and gatherings with large scale crowds. This has caused an obvious disruption in the financial markets and probably will lead to some magnitude of economic downturn or even minor recession. We say minor because in a large way this will be a self-induced slowdown in order to combat the spreading effects of the virus. Once the containment sets in, economic activity will start to rebound and we will have more monetary stimulus at our backs to aid in the recovery. In our earlier letter we projected that governments would step up their efforts to inject confidence either by monetary or fiscal action. This is exactly what has happened in the United States. The Federal Reserve added enormous stimulus to the short-term REPO market to ensure credit markets do not freeze up. Next week the Federal Reserve will meet, and it is widely expected interest rates will be reduced further. The Australian government and Bank of England added support with similar measures.

Market Action

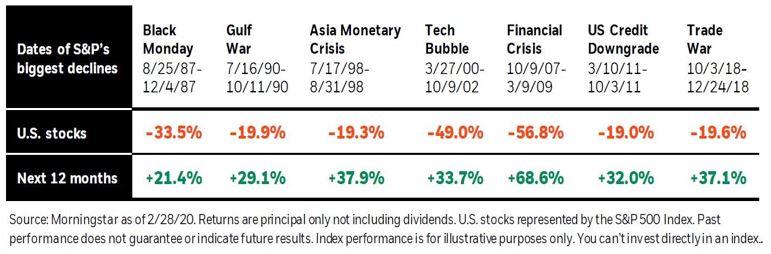

The broad U.S. indices such as the S&P 500 and Dow Jones Industrial Average are well off their highs and have officially entered bear market territory. What is more shocking is the short time frame that this took place. Declines like we just experienced usually happen over months, not weeks. Investors and market participants are left with asking questions about what to do next. Investors must avoid the urge to cash out and sit on the sidelines. This move may provide short-term comfort but could pose long-term challenges. Every severe market downturn has a different recovery in terms of speed and time. Below are several market events that led to quick market drawdowns but were followed by periods of market strength over the next 12 months. History says, with time and patience, sticking to a dedicated asset allocation that suits one’s financial goals is the best recipe for success.

What Happens Next?

We are not at the liberty of predicting the bottom nor will we attempt to do so. However, there are some issues starting to take hold that usually point to a bottoming process. We say process because bottoms are not usually defined in a day or two but over time. First, treasury yields have fallen from earlier year highs, but the shape of the yield curve resembles more of an upward slope. Historically this indicates a recovery is in the works and will take shape at some point in the future. Second, there are trillions of dollars on the sidelines in cash and money markets waiting for an opportunity to be deployed. Third, safe havens like treasuries, dollar/yen and gold all rallied during the depths of the sell-off but now have recently sold off along with equities. This mutual market action leads us to believe that risk is coming off the table everywhere which is another sign of possible capitulation. Lastly, the dividend yield of the S&P 500 is significantly higher than the 10-year treasury which is currently 0.95%. This has historically been a long-term buy signal for investors.

Timing and best guesses aside, our clients financial plans and personal circumstances continue to dictate their asset allocations. We are long-term investors and our focus is to remain aligned with the financial goals and objectives of each of our clients. Our Investment Committee recently met and elected to prudently raise cash to levels that will provide for the next 6-12 months of expenses. Our bond allocations have held their ground in the recent turmoil and any cash we need to raise will come from that portion of the portfolio.

Thank you for your confidence in us and we look forward to answering any questions you may have.